Millennial Retirement Mastery: Bridging the Savings Gap with Smart Strategies

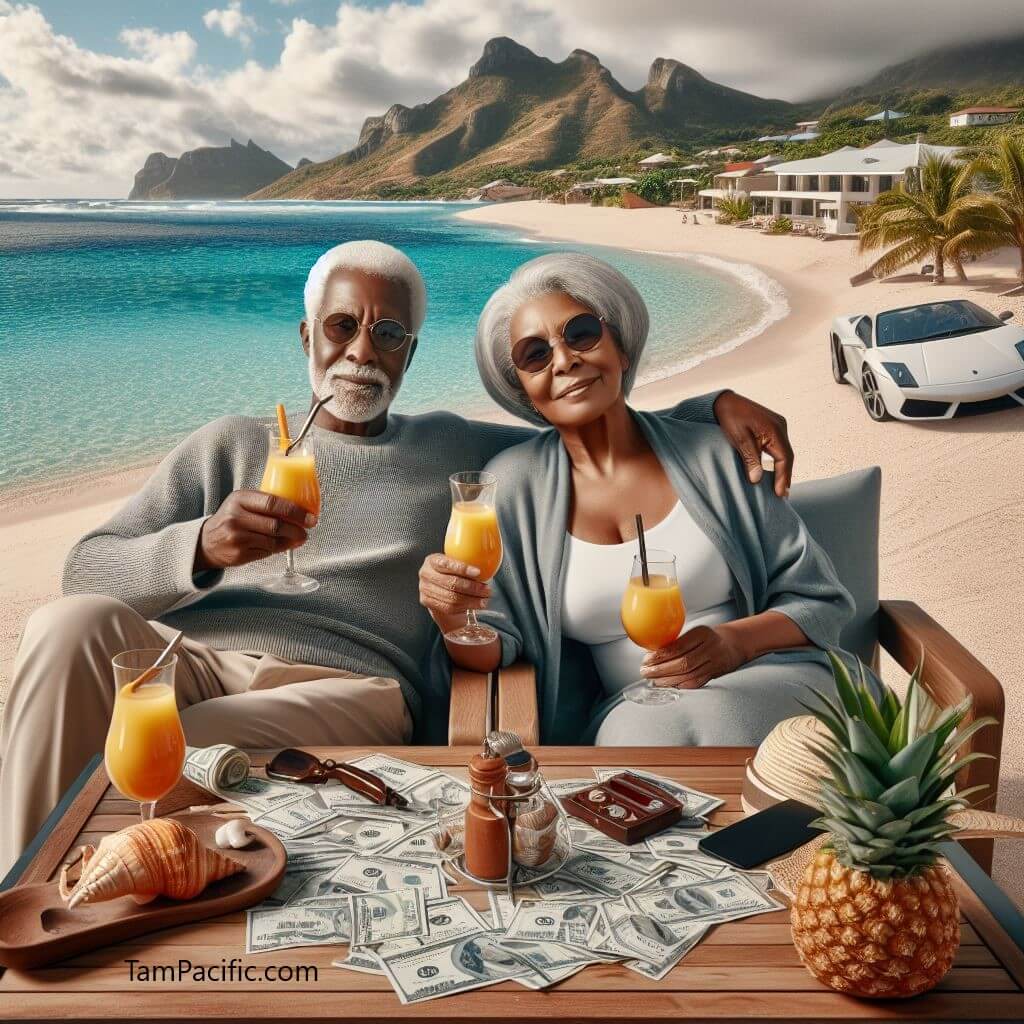

As millennials navigate the complexities of modern financial landscapes, they find themselves at a pivotal crossroads.

Defined by their pursuit of passion and meaningful experiences, this generation envisions an early exit from the workforce, aspiring to break free from the traditional confines of a 9-to-5 career. Yet, this bold vision is met with the sobering reality of financial readiness, or rather, the lack thereof.

Confronted with escalating living costs, burdensome student loans, and volatile job markets, millennials face an uphill battle in securing a stable financial future. Their eagerness to embrace retirement contrasts sharply with the practicalities of economic life, revealing a stark gap between aspiration and feasibility.

This article seeks to unravel the millennial retirement paradox, examining the interplay between their lofty retirement dreams and the economic challenges that stand in their way. By illuminating the intricacies of this dilemma, we aim to equip millennials with the insights and strategies essential for bridging the gap and charting a course toward a secure and fulfilling retirement.

1. The Paradox of Millennial Retirement Dreams

The millennial generation, marked by ambition and a penchant for innovation, harbors a collective dream of early retirement—a vision of financial independence that promises liberation from the daily grind. This aspiration, deeply ingrained in their ethos, is a call for freedom and a life rich with experiences beyond the traditional workplace. Yet, this dream is juxtaposed against a contrasting reality of financial readiness, revealing a paradox that defines the millennial approach to retirement.

– The Desire for Early Retirement vs. Financial Readiness. Millennials, driven by a quest for autonomy and flexibility, envision an early departure from the corporate world, aspiring to retire in their 50s or sooner. This desire, however, often clashes with the stark financial realities they encounter. Despite their readiness to embrace retirement, many find themselves constrained by financial limitations, unprepared for the journey ahead due to insufficient savings and investment.

– The Retirement “Gap”: Perception vs. Reality. The disparity between millennials’ retirement aspirations and their actual financial state is stark. Surveys suggest that millennials anticipate needing a substantial retirement fund, often in the millions, to live comfortably. Yet, the average savings tell a different story, with many millennials having accumulated merely $62,600 – a fraction of what they believe is required for a secure retirement. This retirement “gap” is a significant divide between their perceived needs and the reality of their savings, highlighting a critical challenge in achieving their retirement goals.

– Implications of the Retirement Gap. The implications of this retirement gap are profound, challenging the conventional understanding of retirement and the strategies required to attain it. Millennials stand at a pivotal crossroads, where their desires for an early retirement meet the practical need for a robust financial strategy. The gap not only affects individual planning but also has broader societal repercussions, influencing economic policies and intergenerational dynamics.

In addressing the paradox of millennial retirement dreams, we must navigate the complexities of financial planning, societal expectations, and personal goals. Recognizing the realities of the retirement gap is the first step toward financial resilience. Millennials must engage in informed decision-making, adopting new strategies and a disciplined approach to secure a future that aligns with their aspirations for retirement security and fulfillment.

2. Understanding the Retirement Dilemma

Navigating the retirement landscape, millennials find themselves entangled in a web of aspirations and financial realities. The retirement dilemma they face is a multifaceted one, marked by a complex interplay of expectations, early saving habits, and resilience amidst economic upheaval.

– Analysis of the 2023 Transamerica Retirement Survey. The 2023 Transamerica Retirement Survey offers a window into the minds of millennials, revealing their retirement expectations and planning habits. This pivotal study provides key insights into how millennials view their retirement, highlighting both their concerns and their preparedness for life after work. Dissecting the survey’s findings, we uncover the factors influencing millennials’ retirement plans and the obstacles they must overcome to realize their goals.

– Millennials’ Proactive Approach to Saving. In the face of significant challenges, millennials demonstrate a proactive approach to retirement saving, starting earlier than previous generations. This shift in attitude reflects a generational awareness of the need to establish a solid financial foundation early on. Despite economic uncertainties and societal changes, millennials are committed to prioritizing long-term financial security.

– Financial Resilience Amidst Economic Setbacks. Millennials have been at the forefront of economic turbulence, experiencing the dot-com bubble burst, the Great Recession, and the disruptions caused by the COVID-19 pandemic. Yet, they have shown remarkable resilience, adapting and innovating to navigate these crises. With a commitment to financial prudence, millennials have learned valuable lessons, strengthening their resolve to secure a stable financial future.

As we delve into the retirement dilemma, we embark on a journey to understand the nuances of millennial retirement aspirations and the resilience required to face adversity. A thorough analysis of survey data, generational behavior, and economic conditions provides a clearer picture of the challenges and opportunities that lie ahead for millennials on their path to retirement security. With this knowledge, they are better equipped to forge a path toward financial resilience, making informed decisions and maintaining a steadfast dedication to their long-term financial health.

3. The Impact of Economic Setbacks on Millennials

The journey of the millennial generation through the economic landscape has been fraught with challenges. Marked by a series of global financial crises, their path has been anything but smooth. The dot-com bubble, the Great Recession, and the COVID-19 pandemic have not only tested their resilience but also shaped their financial perspectives and behaviors in significant ways.

– Generational Experiences of Economic Crises. Millennials have experienced the full brunt of recent economic downturns. These events have etched a lasting impact on their collective psyche, influencing their approach to money, savings, and investment. The aftermath of these crises has led to a generational shift in how millennials view financial stability and security.

– Shaping Financial Attitudes and Behaviors. In response to economic adversity, millennials have developed a robust spirit of resilience. They’ve become more resourceful and vigilant in their financial planning, often adopting a cautious optimism. This shift is a direct result of their lived experiences, which have underscored the importance of adaptability and prudent financial management.

– Challenges in Achieving Financial Stability. Experts point out that millennials face unique hurdles in their quest for financial stability and retirement security. Burdened by student loan debt, stagnant wages, and uncertain job markets, they must navigate an ever-evolving economic environment. These challenges require millennials to be more strategic and proactive in their financial planning than previous generations.

– Resilience and Resolve. Despite these obstacles, millennials are not passive victims of their circumstances. Instead, they are active participants in shaping their financial futures. Armed with the lessons from past economic setbacks, they are carving out paths toward financial resilience. This generation is redefining what it means to be financially secure, leveraging their experiences to build a more stable and promising future.

4. The Financial Realities Facing Millennials

Millennials, the generation coming of age in a rapidly changing economic era, face a unique set of financial challenges that directly impact their ability to achieve retirement security.

– Navigating Rising Costs and Market Challenges. The financial landscape today is marked by rising living expenses and a volatile housing market, both of which pose significant barriers to millennials’ financial goals. The cost of living continues to climb, driven by inflation and the high demands of urban lifestyles. Healthcare, education, and housing costs have all seen dramatic increases, leaving many millennials struggling to keep up. The dream of homeownership is particularly elusive, as the housing market becomes increasingly inaccessible due to high prices and limited affordability.

– The Retirement Income Gap. As millennials approach retirement age, concerns about income inadequacy become more pressing. Projections suggest that many in this demographic may face a shortfall, with their savings and investment strategies falling short of what is needed to maintain their standard of living in retirement. This gap is a wake-up call for millennials to reassess their financial strategies and take proactive steps towards securing their future.

– Expert Insights into Retirement Readiness. Experts in financial planning and economics provide critical insights into the factors influencing millennials’ readiness for retirement. They point to a combination of behavioral, economic, and socio-cultural factors that determine how well millennials are preparing for their later years. These insights underscore the importance of understanding the broader economic context and individual behaviors that contribute to retirement outcomes.

– Opportunities Amidst Challenges. Despite the daunting financial realities, there are opportunities for growth and empowerment. Informed decision-making, strategic financial planning, and collective action can pave the way for millennials to overcome obstacles and achieve financial security. By embracing these opportunities, millennials can work towards a future where retirement prosperity is a reality, not just a dream.

5. Strategies for Millennial Retirement Success

In the quest for retirement success, millennials must navigate a financial landscape that is vastly different from that of previous generations. With a blend of ambition and determination, strategic planning becomes the cornerstone of their journey to financial independence.

– Embracing Financial Planning and Saving Habits. The foundation of a successful retirement for millennials lies in a comprehensive approach to financial planning. This includes budgeting, expense tracking, investment diversification, and risk management. It’s crucial for millennials to develop saving habits that align with both their immediate needs and their long-term retirement goals. Utilizing tools like compounding interest, tax-advantaged accounts, and employer-sponsored retirement plans can significantly bolster their financial stability.

– The Critical Role of Early and Consistent Saving. Financial experts consistently highlight the importance of starting the saving process early and maintaining consistency. The earlier millennials begin to save, the more they can benefit from compound interest, which can exponentially increase their retirement funds over time. A disciplined approach to saving, coupled with strategic investments, can help mitigate the effects of market fluctuations and economic uncertainties.

– Tailoring Strategies to Individual Needs. Financial planning is not one-size-fits-all, especially for a generation as diverse as millennials. It’s essential to consider individual circumstances, preferences, and life stages when crafting a financial plan. For those just starting their careers, priorities may include paying off debt, establishing an emergency fund, and taking full advantage of employer retirement contributions. As millennials progress in life, their financial strategies may shift to focus on homeownership, family planning, and career development.

– Charting a Path Forward. By adopting a dynamic and adaptable financial planning approach, millennials can confidently face life’s challenges and changes. Strategic planning, disciplined saving, and informed guidance are key navigational tools that can lead millennials to a future marked by prosperity and fulfillment. With a commitment to their long-term financial health, millennials are well-positioned to take control of their financial destinies and achieve the retirement security they aspire to.

6. Navigating the Road to Millennial Retirement

As millennials chart their course towards retirement, they face a landscape brimming with challenges and uncertainties. Yet, it is their proactive planning, strategic decision-making, and determination that light the way to a successful financial future.

– Embracing Complexity with Optimism. The road to retirement for millennials is complex, marked by high living costs and economic volatility. These challenges necessitate a nuanced approach to financial planning that balances immediate needs with long-term goals. Despite these hurdles, there is a strong cause for optimism. Millennials possess the potential to achieve retirement security through informed choices and consistent, long-term planning efforts.

– The Power of Proactive Financial Planning. Millennials must take an active role in their financial futures. By engaging in proactive financial planning and making strategic decisions, they can navigate through and overcome the obstacles to financial security. Disciplined saving, wise investing, and a commitment to long-term planning are the pillars that will support their journey towards retirement success.

– Redefining Retirement. Millennials are poised to redefine the traditional narrative of retirement. Through education, innovation, and collaboration, they can break down the barriers to financial independence. This generation has the opportunity to transform challenges into opportunities, setting the stage for a future rich with prosperity and fulfillment.

In conclusion, while millennials may encounter numerous obstacles on their path to retirement, the destination of financial security and independence is attainable. With proactive planning, strategic decision-making, and unwavering determination, millennials can confidently navigate the financial landscape, securing a prosperous retirement.

7. Empowering Millennials for Retirement Success

As the millennial generation forges ahead on the path to retirement, it is crucial to activate a network of resources and support that empowers them to achieve financial independence and readiness for retirement.

7.1. Mobilizing Resources and Support Networks

Millennials should be encouraged to tap into a variety of resources designed to enhance their financial literacy and retirement planning:

– Financial Education Platforms: Utilize online resources, workshops, and seminars to build a strong foundation in financial knowledge.

– Savings and Investment Tools: Employ budgeting apps, retirement calculators, and investment platforms to optimize financial strategies.

– Professional Financial Guidance: Seek personalized advice from certified financial planners or advisors to navigate individual financial landscapes.

– Community and Peer Support: Engage in communities and forums where experiences and strategies can be shared and discussed.

– Employer-Sponsored Programs: Maximize benefits from employer-sponsored retirement plans and understand the options available, including matching contributions.

7.2. The Role of Collective Action and Advocacy

A concerted effort is needed to address the broader systemic issues affecting millennials’ ability to retire comfortably:

– Policy Advocacy: Push for policies that improve access to healthcare, housing, and fair employment, directly influencing retirement prospects.

– Employer Benefits: Encourage the expansion of benefits such as retirement savings matches and student loan repayment assistance.

– Educational Initiatives: Promote financial education that begins early and continues through higher education, equipping millennials with essential skills.

– Societal Awareness: Increase dialogue and understanding about the retirement challenges millennials face, moving beyond stereotypes to foster empathy.

By leveraging these resources, tools, and collective efforts, millennials can take charge of their financial futures. It is through informed decision-making, strategic planning, and societal support that millennials can navigate the road to retirement, transforming challenges into opportunities for success and fulfillment.

Author: Tam Pacific

Clip 1: Early Retirement in One Lesson (or How I Retired at 30): This video features a talk by Mr. Money Mustache at the 2016 World Domination Summit. He discusses the concept of early retirement and how to achieve financial independence while still young. The focus is on getting wealthy enough so that you never have to work again, emphasizing the importance of saving and living frugally to retire early.

Clip 2: How To Retire At 30 Living Off Investments: Ryan Scribner shares insights on retiring early by living off investments. He discusses the importance of starting to invest early, creating multiple income streams, and having a disciplined approach to saving. The video aims to provide viewers with strategies to retire at 30 through careful financial planning and investment.

Clip 3: How to Retire in 10 Years (starting with $0): Ali Abdaal outlines a framework for retiring early, even if starting from scratch. He breaks down the process into actionable steps, focusing on saving a significant portion of income, investing wisely, and creating passive income streams. The video is designed to help viewers understand the principles of early retirement and how to plan for it effectively.

You are viewing the article:

Millennial Retirement Mastery: Bridging the Savings Gap with Smart Strategies

Link https://tampacific.com/blog/millennial-retirement-mastery-bridging-the-savings-gap-with-smart-strategies.html

Hashtag: #MillennialRetirement #RetirementPlanning #FinancialFreedom #RetirementGoals #SavingsGap #EconomicChallenges #FinancialWellness #RetirementReadiness #InvestingForTheFuture #EarlyRetirement

Next article: The Art of Upgrading: Expert Tips for Accessing First Class at No Extra Cost

* This work is licensed under a CC-BY 4.0 International License.